Hipgnosis: Sustainable or Momentary Music Disruptors?

Taking a closer look at the company leading the music IP gold rush

GM readers 👋,

Happy November!

It’s been a couple months since the last newsletter. But we’re back with a look at a fascinating company – if it weren’t, I don’t think I could have written 7,500+ words.

*Due to a Substack technical issue causing the original post to get cut off, we’re re-publishing this piece.*

This month we’re covering a space that is likely becoming familiar to consistent readers of this blog. As someone who has been researching and writing about the music IP industry a lot recently, I’m excited to bring you Leveling Up’s second ever company-focused post. For this one, we’re deep diving into Hipgnosis – the company arguably leading the music IP gold rush, but also facing questions in the wake of its recent Annual Report and a turbulent macro environment.

As a reminder, these company-specific deep dives are intended to explore what businesses are up to, speculate where they might be going, dissect their risks to getting there, etc. In short, I hope to “level up” my understanding of them. Importantly, I’m not trying to shill any investments.

And with that, on to the disclaimers…

Note: I write this newsletter to learn in public. This piece is for informational purposes only. None of this is financial or legal advice. I don’t have any investment holdings in Hipgnosis. Do your own research!

One more thing. I’ll be in NYC next week (the week of November 14th). I’d love to catch-up and chat about consulting, investing, partnerships, and more. If you’d like to grab a coffee, please shoot me an email or fill out this form – even if it’s for a quick hello!

Thanks again for reading. As always, I’d love to hear your ideas / feedback in the comments.

Now, let’s get after it!

Jimmy

PS if you’re not already a subscriber to Leveling Up and don’t want to miss out on future newsletters, feel free to enter your email below and you’ll receive new posts directly in your inbox:

Hipgnosis: Sustainable or Momentary Music Disruptors?

“Investment success doesn’t come from ‘buying good things’, but rather from ‘buying things well’.” - Howard Marks, Co-Founder of Oaktree Capital Management

Hipgnosis has been a hot topic in music and finance circles over the past few years. The four-plus year old company has accomplished some impressive financial milestones in its relatively short history:

A vehicle for public market investors to access ownership interests in hit songs, via Hipgnosis Songs Fund’s (“HSF”) listing on the London Stock Exchange

$2.2+ billion valuation, as calculated by HSF’s independent third-party valuer for its most recent annual report

£1.3 billion of equity and more than $600 million of debt raised

$168+ million of revenue and 22% year-over-year revenue growth off of a meaningful base

156 Grammy winners and 3,854 number 1 hits among its 65,413 songs

Over 90 employees at HSF and Hipgnosis Song Management (per LinkedIn)

And that’s all ignoring its recent ~$1 billion partnership with Blackstone, the world’s largest alternative asset manager. (We’ll discuss Hipgnosis’ group structure later in this piece.)

Meanwhile, its outspoken founder Merck Mercuriadis (“Merck”) has sought to use his platform to shake up industry power structures. In 2019, Merck shared a five point “manifesto”, in which he outlined the ways he’s aiming to disrupt the music industry. It includes improving the percentage of revenue received by songwriters and ensuring artists – rather than record companies – own their master recording copyrights. Simply put, in addition to building a profitable business, Hipgnosis seeks to advocate for better economic terms for music creators.

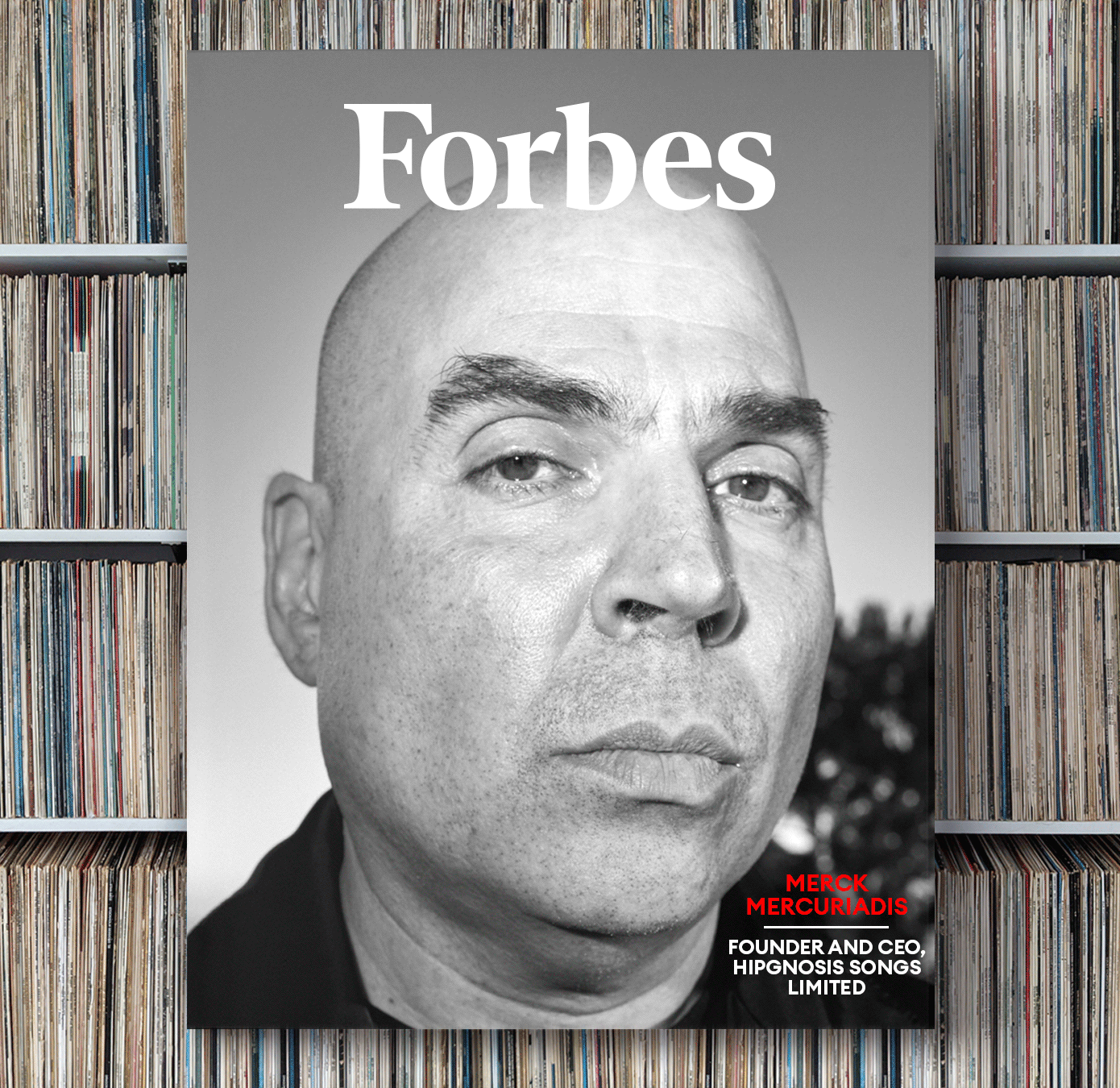

Hipgnosis’ success and ambitious goals have attracted a deluge of media attention. Featured articles have been written about the company and its founder in a variety of major national and music industry publications, including The New York Times, Billboard, and Rolling Stone.

However, these articles haven’t always been effusive in their praise. In 2021, a Forbes cover story entitled “Meet Music’s Most Hated Man – And Its Top Dealmaker” interviewed an analyst at investment bank Stifel, who questioned Hipgnosis’s accounting practices and the prices it pays to acquire music catalogs. At that time, Merck responded to the Stifel analyst’s comments as naive, reportedly dismissing them as “a small analyst that wanted to put a spotlight on themself by having a contrary voice.” Spicy stuff!

More recently, critics’ voices have increased in volume, as the stock market and broader economic conditions have wobbled. In early September 2022, the Financial Times published several critical articles about Hipgnosis and its independent valuer The Massarsky Group, questioning (among other things) HSF’s ability to continue funding its dividend payouts and Massarsky’s conflicts of interest when determining catalog valuations. These comments are particularly interesting when juxtaposed against other articles and Hipgnosis’ own press releases that suggest HSF’s business is performing well and the value of its song portfolio continues to grow.

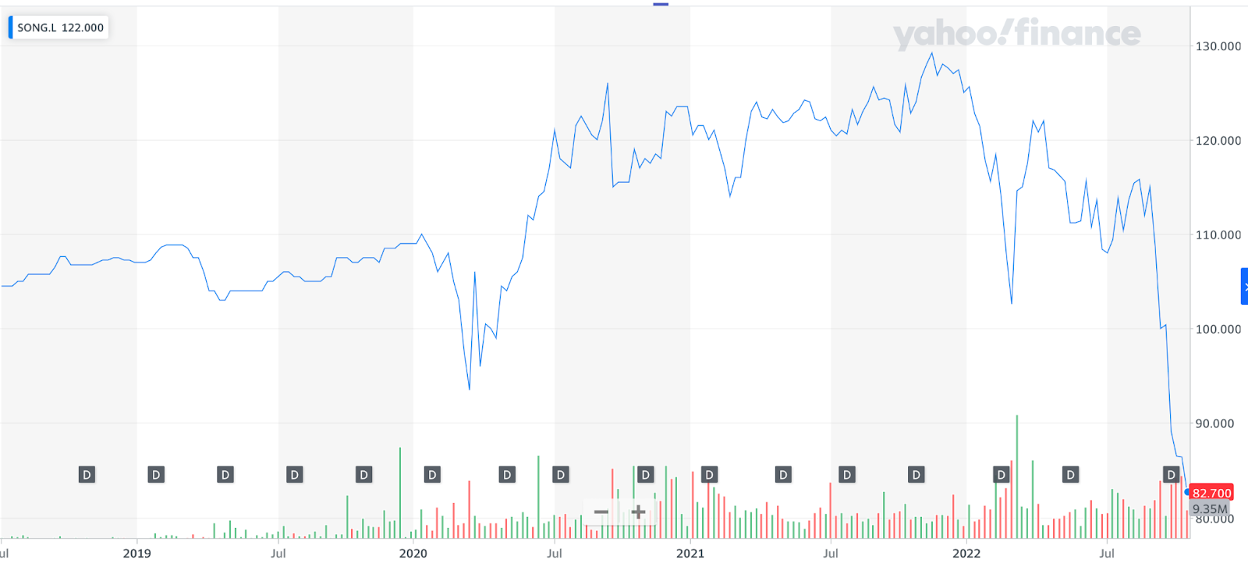

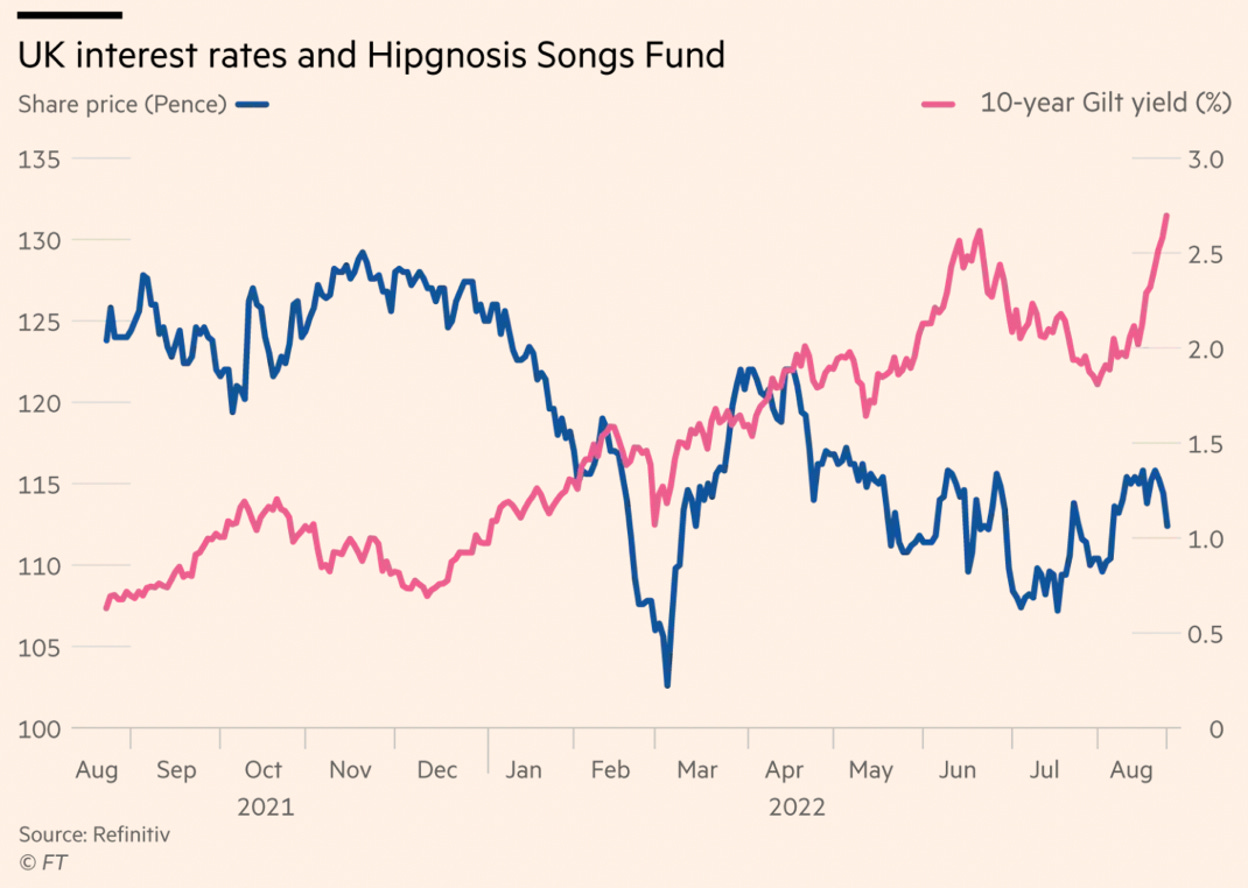

Meanwhile, from early September to October 19, HSF’s stock price has fallen nearly 30%, significantly underperforming the S&P 500’s 7% decline over that period.

Hipgnosis is a business that has grown at the pace of a start-up via an aggressive acquisition strategy. It has acquired timeless catalogs and arguably led the music IP boom, while trying to alter long standing industry power structures. At the same time, recent critiques and HSF’s stock price performance suggest that its future is more uncertain than ever. If Hipgnosis’ ambitious goals, controversial execution, and juicy anecdotes have piqued your interest, I’m right there with you.

So, which is it? Is Hipgnosis a sustainable music disruptor, or is it ultimately flying too close to the sun?

I haven’t come across many businesses that are this divisive. Let’s study Hipgnosis and try our best to answer this question by covering:

Where did Hipgnosis Come From?

From Artist Manager to Leading the Music IP Gold Rush

The Hipgnosis Organizational Structure

What is Hipgnosis’ Approach to Proving Songs are Investable?

How is Hipgnosis Faring and Where is it Headed?

How Might Hipgnosis’ Potential Risks be Mitigated?

Grab a cup of coffee, turn down the volume, and let’s learn from this fascinating company!

Where did Hipgnosis Come From?

Hipgnosis was established by Merck Mercuriadis in 2018. Merck was born in a small town in Quebec, Canada and broke into the music industry at 19 years old. After sending cold letters to his favorite label Virgin Records, Merck’s determination paid off and he was hired into the marketing department at Virgin Canada in the early 1980s.

In 1986, he joined Sanctuary, a label and management company, and spent much of his career there, eventually rising to the CEO position in 2004. At Sanctuary, Merck demonstrated himself to be a shrewd marketer and advocate for creators, managing an impressive number of award winning artists and songwriters, including Sir Elton John, Guns N Roses, Diane Warren, Destiny’s Child, and Iron Maiden.

What comes up over and over again in interviews with songwriters and artists is Merck’s passion for music, his respect for creators, and his charm. Here are a couple examples:

“He’s always been bonkers obsessed about songs. He can recite lyrics to the most obscure B-side of a Eurythmics song. He can actually mumble them. Well, he’s not a great singer.” - Dave Stewart of the Eurythmics

“I know his passion for music. I know that he spends his weekend playing vinyl because he’ll text me ‘Hey I’m listening to this today. You should put it on.’ … Selling to Merck is like giving something of real value to somebody else who would value it the way you did.” - Manager of Tricky Stewart, who has written hit songs for several artists, including Beyonce, Rihanna, and Justin Bieber

After two decades at Sanctuary, Merck’s time leading the company was short-lived, as he resigned in 2006 – less than two years after assuming the leadership post. Ultimately, the company was sold to Universal Music one year after Merck’s resignation, amid mounting losses and accounting errors that caused the company to dismiss its co-founder, Andy Taylor. In interviews, Merck has attributed Sanctuary’s struggles to the broader decline in recorded music industry revenues during the post-Napster era. Wall Street analysts covering Sanctuary also blamed “overambitious expansion”, like the company’s purchase of Music World Entertainment, the US urban management company owned by Beyonce’s father, Mathew Knowles. In short, Sanctuary appears to have run into the perfect storm: a combination of a severe industry downturn coupled with self-inflicted missteps.

After resigning from Sanctuary, Merck focused on his artist management clients – which included Guns N Roses and Morrisey – for the next decade. And then in 2017, he began to pitch investors on his next venture: Hipgnosis.

The company is named for an English design group of the same name that created album cover designs for rock musicians such as Led Zeppelin, Pink Floyd, and Genesis. Storm Thorgerson, a co-founder of the design firm and former Merck management client, designed Hipgnosis’ logo (pictured below) of “an elephant that is blown away by how good the songs are.”

During an interview with the journal Thought Economics, Merck described his motivations to start a music IP investment vehicle after a career spent at artist management firms and record labels:

"Nile [Rodgers] and I have always believed that hit songs and music, art in general, has real value to it. What people don’t really recognise is that when a song becomes a proven song, the earnings pattern to it becomes very predictable and reliable, and is therefore investable. And these songs are as valuable as gold, or oil…Nile and I, one day, just started riffing off of these ideas of how do we change this system, how do we change what’s going on today where the songwriter – who provides the most important component in an artist having success – is the lowest person on the totem pole?”

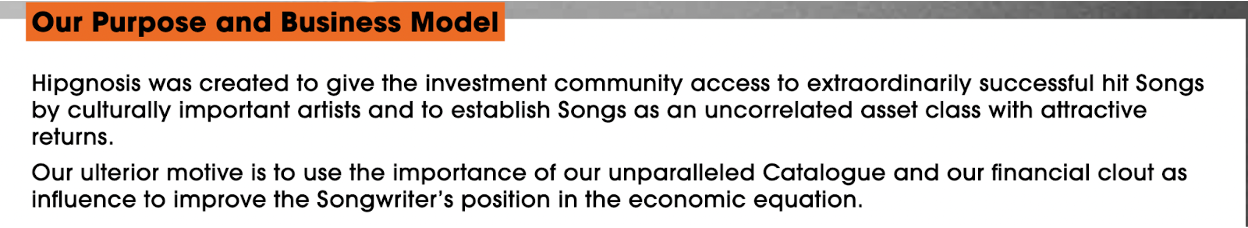

Boiling down these comments, Hipgnosis’ high-level vision (detailed on Hipgnosis Songs Fund’s website) is multifaceted:

Give Investors Direct Access to Music IP. Hipgnosis wants to give investors access to proven songs by culturally important artists.

Prove Music IP is an Investable Asset Class. The company wants investors to recognize music IP as an uncorrelated asset class with attractive returns…”as valuable as gold or oil.”

Use its Financial Standing to Advocate for Better Songwriter Economics. The company wants to leverage its “financial clout” to change the way that the music industry works by advocating for songwriters to be paid more. (I’ve written about how songwriters can receive less than 10% of the pie for every $10 consumers pay to streaming services after platform fees, labels, publishers, and artists are paid.)

The next step was convincing investors that this vision and the team executing it were worth betting on.

From Artist Manager to Leading the Music IP Gold Rush

After spending more than a year pitching investors, Hipgnosis Songs Fund (“HSF”) successfully listed on the London Stock Exchange in July 2018, raising ~$265 million from public market investors. In an interview the day of HSF’s IPO, Merck stated that he wanted to return to the public markets again with the goal of raising £1 billion. At that scale, Merck believed that Hipgnosis could successfully advocate for songwriters, stating: “At £1 billion, we will be 18 or 19 percent of global publishing. At that point, we will have the critical mass to effect the change.”

At the time, Hipgnosis Songs Fund had a unique pitch. Prior to Hipgnosis, large private market investors – such as pension funds – could directly access music IP assets, but there really weren’t any vehicles of meaningful size for public equity investors to directly invest in music IP. Mills Music Trust (ticker: MMTRS) was the only publicly listed pure-play music IP vehicle at the time, but its ~$10 million market cap and tiny daily trading volume made it pretty inaccessible. Meanwhile, Universal Music and Sony Music were a part of large media conglomerates (Vivendi and Sony, respectively), and other music rights holders, such as Warner Music, Round Hill Music, and Reservoir, were still private at the time.

Since HSF’s IPO, several music rights holders have gone public, providing public equity investors with greater access to this asset class. But even Hipgnosis’ competitors have credited the company for its relatively early pursuit of a public listing via the LSE. In short, Hipgnosis’ public listing accomplished one aspect of its vision by giving a new type of investor direct access to music IP.

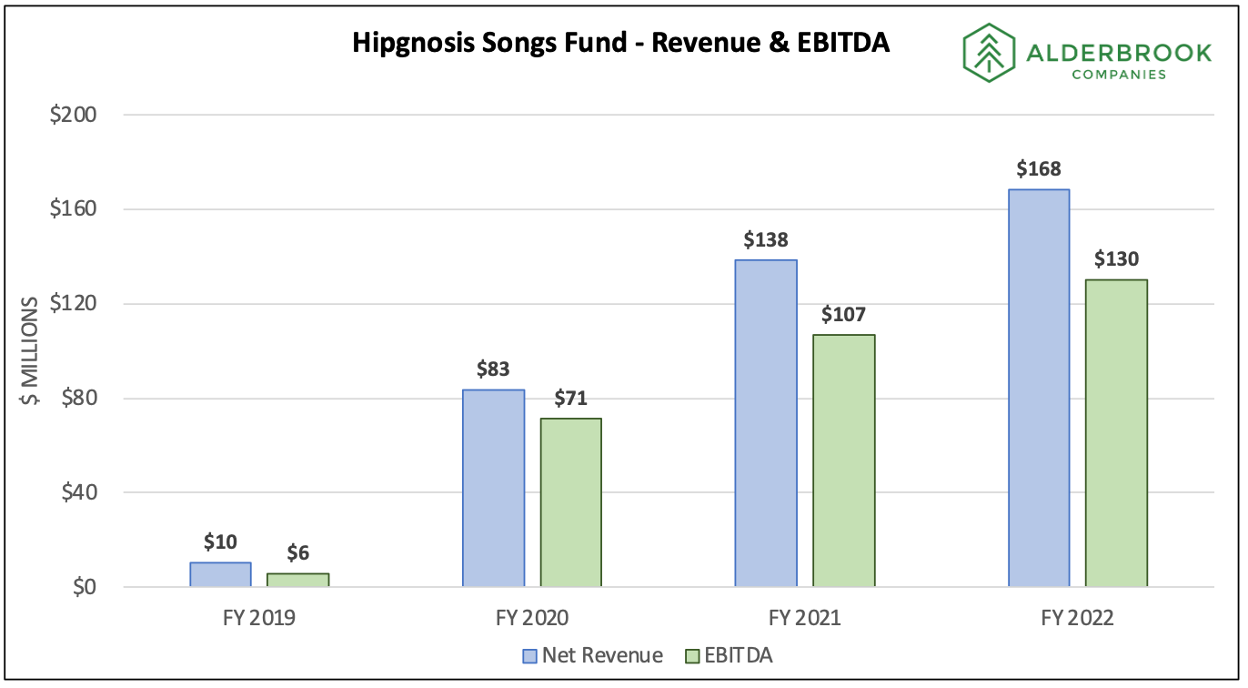

With this initial funding secured, the Hipgnosis team wasted little time deploying the capital and building a significant business. At the beginning of 2018, Hipgnosis wasn’t much more than an idea. Roughly four years later, HSF’s net revenue and EBITDA has grown to $168 million and $130 million, respectively.

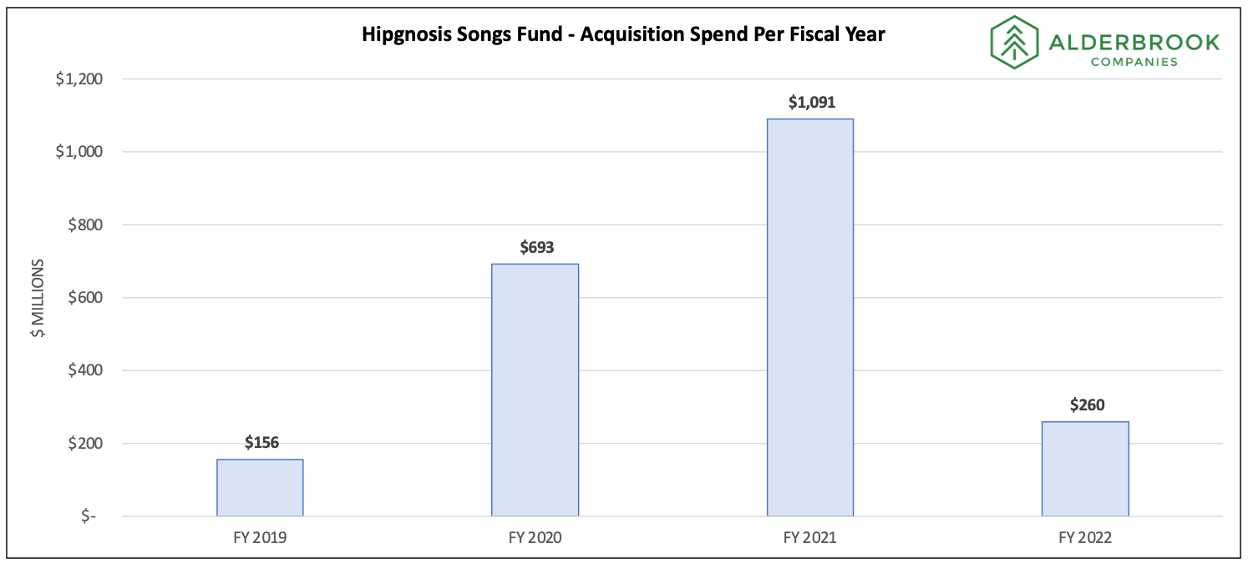

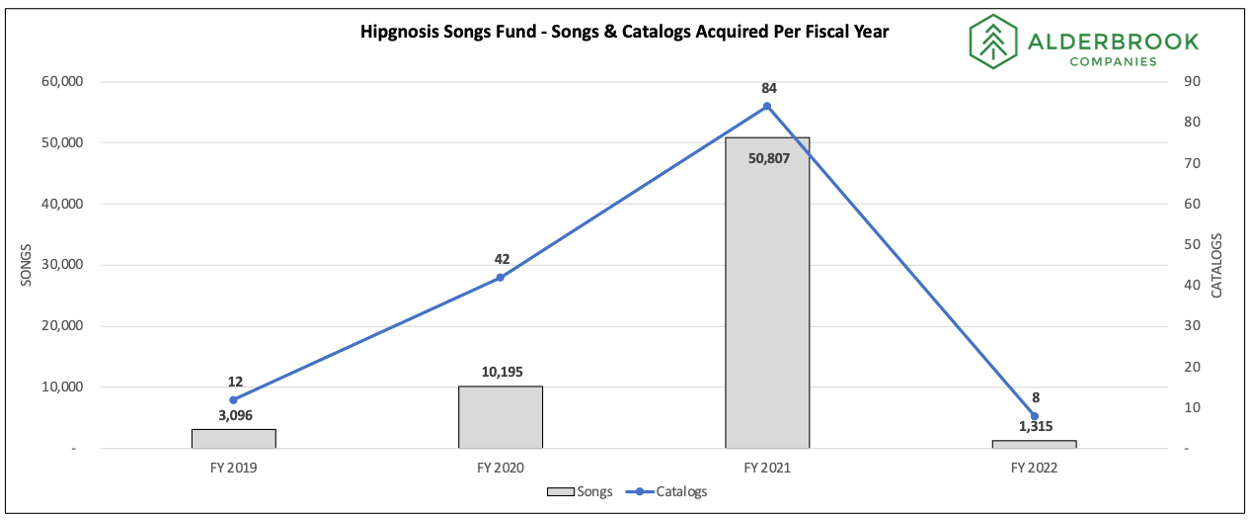

How did Hipgnosis Songs Fund accomplish this exponential growth so quickly? The company’s primary growth driver has been an aggressive acquisition strategy. Since inception, HSF has deployed ~$2.2 billion in total on 146 catalogs and 65,413 songs.

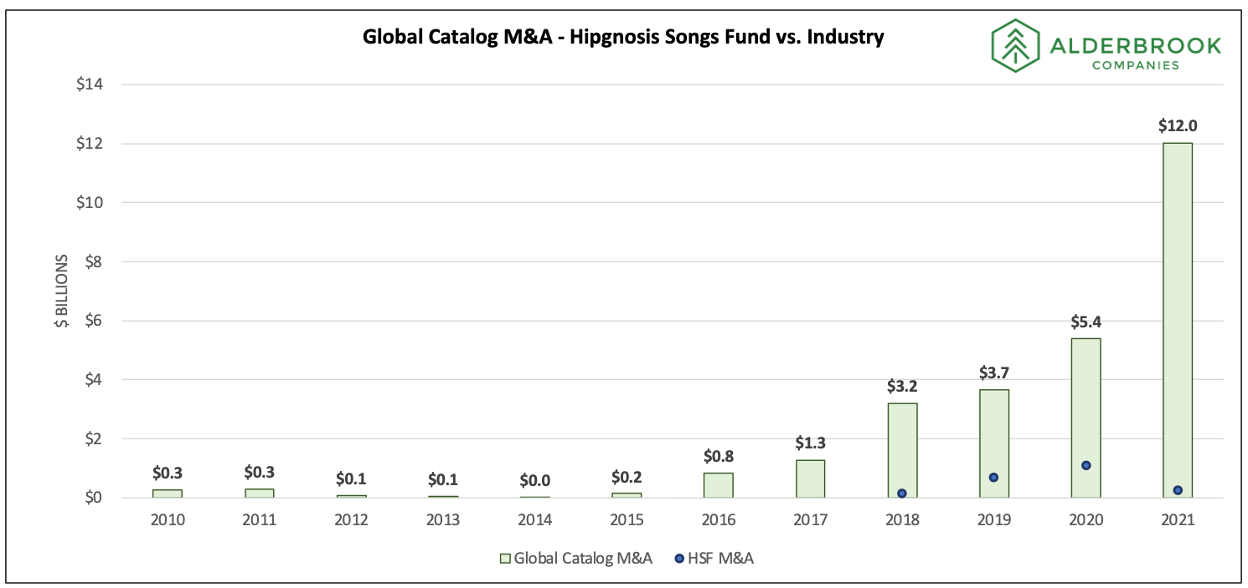

For context, MiDIA Research analyzed global catalog deal transaction values since 2010. After averaging $100 - $300 million of deals from 2010 to 2015, activity started to tick up to $1 billion between 2016 to 2017, and then exploded above $3 billion after 2018 (the year of HSF’s London Stock Exchange debut). Essentially, Hipgnosis Songs Fund has gone from pitching investors an idea to acquiring more catalogs in a given year than the entire global catalog M&A market in the early 2010s. In 2019 and 2020, the company accounted for ~20% of global catalog M&A transaction volumes.

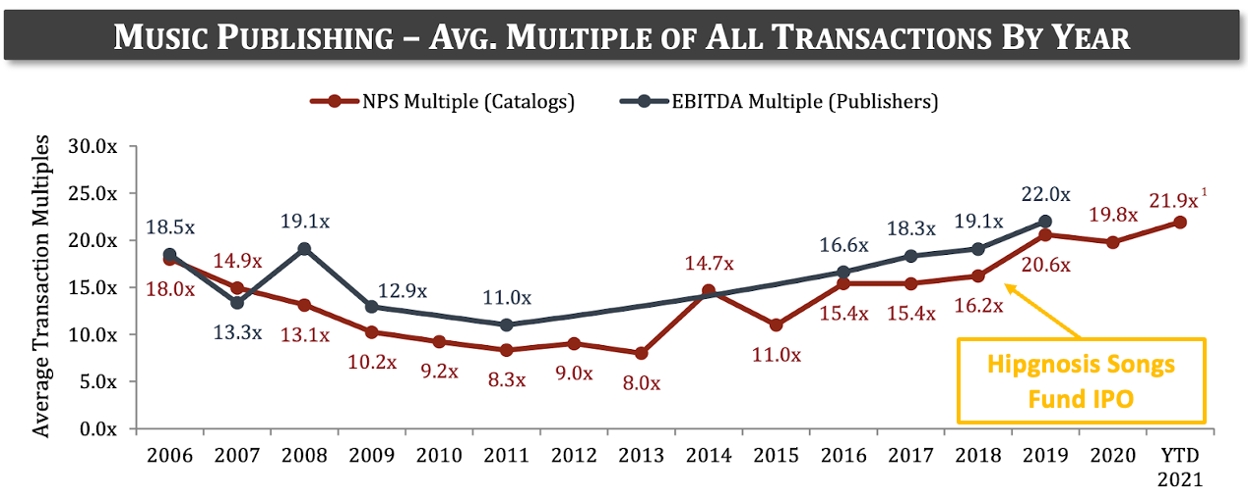

Hipgnosis’ aggressive entrance into catalog M&A has contributed to a meaningful uptick in competition and catalog valuations. As Hipgnosis has scaled its portfolio, more music catalog dedicated funds backed by major Wall Street asset managers (Apollo, Blackrock, Carlyle, KKR, Oaktree Capital, Pimco, Providence Equity Partners, etc.) have been attracted to the space. The growing number of buyers looking to purchase iconic music assets has unsurprisingly impacted prices. Investment bank Shot Tower Capital estimates that the average publishing catalog multiple increased ~40% from 15.4x net publisher share in 2017 (the year before HSF’s IPO) to almost 22x in the first half of 2021.

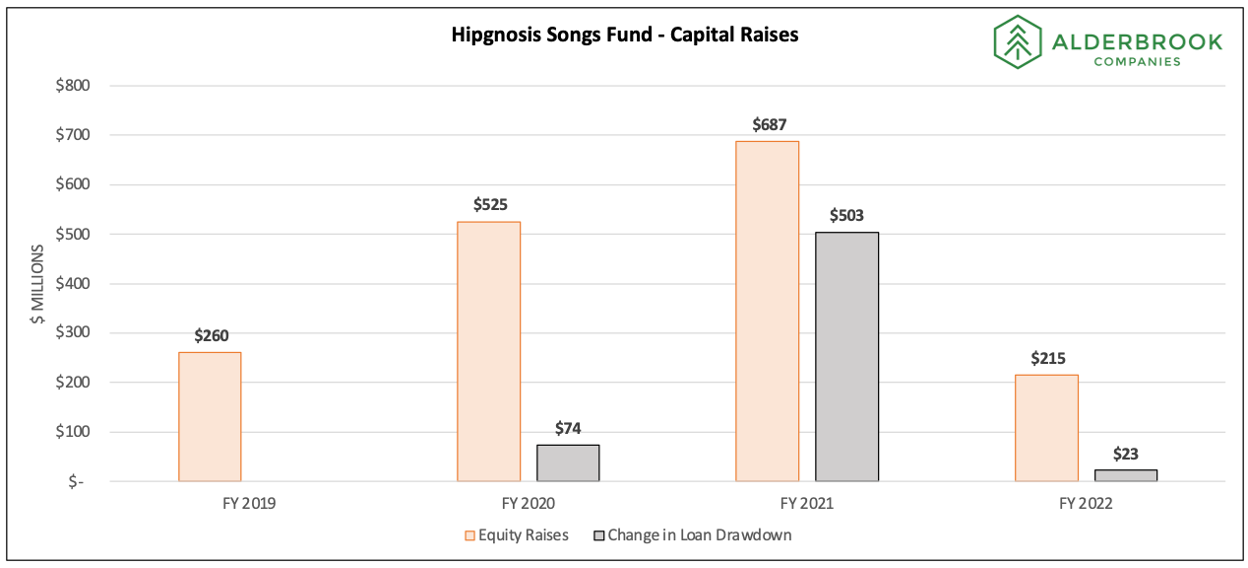

At the same time, it’s worth noting that HSF’s acquisition pace slowed down considerably in the past 12 months. The two charts above show how the company’s activity peaked in fiscal year 2021 (which is primarily calendar year 2020 since HSF’s fiscal year ends March 31st) before plummeting in fiscal 2022 (calendar year 2021).

How did Hipgnosis acquire so many catalogs in such a short period? And why does activity at Hipgnosis Songs Fund appear to be slowing down?

In three words: access to capital. Hipgnosis Songs Fund's ferocious acquisition appetite has unsurprisingly required a lot of capital. Since July 2018, HSF has raised over £1.3 billion (~$1.7 billion) of equity capital across eight different placings to build its portfolio of songs. HSF has also drawn down on larger and larger debt facilities to fund its acquisitions, ending fiscal year 2022 having fully drawn on its $600 million credit facility.

After a flurry of equity issuances, the company hasn’t issued any new equity since July 2021. The slower pace of acquisitions at Hipgnosis Songs Fund has been driven by access to new capital from public market equity investors. To avoid a sudden stop in deal activity and to bolster internal financial capabilities, Hipgnosis Song Management (HSF’s investment adviser; we’ll discuss Hipgnosis’ corporate structure in detail later) entered into a $1 billion partnership with alternative asset manager Blackstone in October 2021. This separate and newly capitalized investment vehicle, called Hipgnosis Songs Capital, has remained active over the past twelve months, acquiring several catalogs. However, Hipgnosis Songs Capital’s acquisition terms are undisclosed and are therefore excluded from the tables above.

Regardless, Hipgnosis Songs Fund’s acquisitions have yielded a formidable song portfolio. It includes 52 of Rolling Stone’s The 500 Greatest Songs of All Time, 67 of the 271 songs in Spotify’s Billion Streams Club, 156 Grammy winners, 3,854 songs that have held number 1 positions in global charts, and 14,381 songs that have held Top 10 positions in global charts. The company has acquired interests in songs associated with dozens of superstar artists, including Tupac Shakur, Beyonce, Nirvana, Kanye West, Journey, Neil Young, Rihanna, Fleetwood Mac, The Chainsmokers, and more. In addition to purchasing catalogs directly from creators, HSF has also acquired a traditional music publishing company (Big Deal Music) and assets from another music IP fund (Kobalt Capital’s Fund I portfolio).

In addition to its incredible song portfolio, the company has continuously been outspoken about improving songwriter economics. For example, Hipgnosis has submitted evidence to and met with UK government authorities investigating the major music companies’ relative market dominance. Meanwhile, Merck has highlighted the issue whenever given the opportunity, and talked about forming a songwriters guild, which he would like to behave in a similar manner as Hollywood’s Screenwriters’ Guild (SAG-AFTRA). At times, Merck has been outspoken against the traditional music publishing industry. He has pointed out potential conflicts of interest at industry organizations – like the National Music Publishers Association (“NMPA”) – arguing that the major publishers, who support the NMPA, may not always have songwriters' best interests in mind.

Since Hipgnosis’ inception, songwriters have experienced positive royalty rate changes, with both mechanical streaming and physical rates increasing significantly. That said, it’s debatable how influential Hipgnosis has been to reach these outcomes. Hipgnosis is a growing, albeit still small, global publishing market player. Based on Spotify Chief Economist’s Will Page’s market size analysis, the total music publishing market size is over $13 billion. Given that, Hipgnosis’ ~$200 million of gross revenue makes up less than 2% of total music publishing industry revenue. Hipgnosis would need to purchase more than $30 billion of assets (assuming a 15x+ multiple) to achieve the 18%+ market share that Merck envisioned at the time of its IPO. In addition, Hipgnosis does not currently have administration rights (i.e., have a direct hand in the money collection process) for most of its portfolio. HSF only administers royalty income in the US for 22% of the catalogs and 8% of the songs in its portfolio. Music industry journalist and entrepreneur Cherie Hu has pointed out that Hipgnosis’ lack of control over its songs gives it less leverage than other industry players, when arguing for higher rates from the government and technology companies. Even if Hipgnosis has not been the primary driver of these rate changes, it has helped shine a light on the issues facing songwriters.

In summary, over the course of four-plus years, Hipgnosis has gone from an idea to a team capable of executing Merck’s vision. The company has raised more than $2 billion of equity and debt capital, and then deployed this capital into an iconic song portfolio. Merck and Hipgnosis has played a leading role in transforming the investment community’s view of the music IP asset class, causing BMG CEO Hartwig Masuch to describe the M&A environment as a “feeding frenzy.” All the while, Hipgnosis has advocated for songwriters to receive what it deems to be fairer compensation. To date, this has resulted in Hipgnosis Songs Fund achieving a $1+ billion valuation and its stock being added as a constituent of the FTSE 250 Index.

What a ride! Truly impressive.

The Hipgnosis Organizational Structure

Before discussing where Hipgnosis is headed, let’s quickly cover its current organizational structure. There are a few moving parts and it’s important to understand them. Hipgnosis isn’t structured as one company with one group of shareholders and a management team with a fiduciary duty to serve these shareholders. Laying out this structure will help us better assess incentives between the various stakeholders within the group of companies making up Hipgnosis.

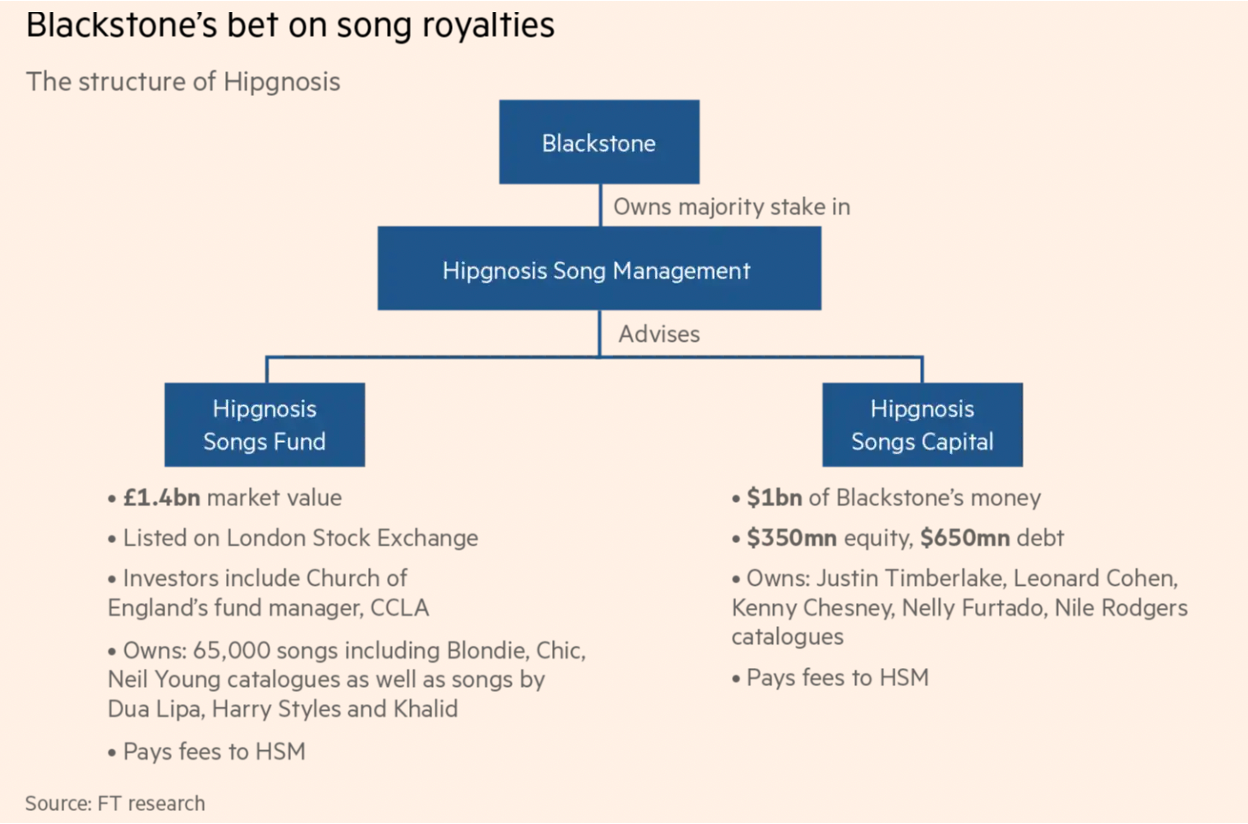

As depicted in the table above, Hipnosis’ structure includes three main entities:

Hipgnosis Song Management (“HSM”, formerly known as The Family (Music) Ltd.) is an investment advisor run by Merck and his ~90 person team. In addition to HSM’s management team (depicted below), the company has an advisory board of successful music industry experts (e.g., songwriters, artists, and executives) who help HSM source new investment opportunities. HSM sources new catalog deals and provides buy/sell recommendations to Hipgnosis Songs Fund (“HSF”) and Hipgnosis Songs Capital (“HSC”), described below. HSM also manages the music IP portfolios owned by HSF and HSC, which includes managing royalty collection and developing strategies to increase royalty income by placing them in movies, video games, viral TikTok videos, etc. In exchange for these services, HSM is paid an advisory fee and performance fee (when applicable) by HSF and HSC. In October 2021, Blackstone reportedly acquired a majority stake in HSM with two of three HSM directorships now held by Blackstone team members.

Hipgnosis Songs Fund (“HSF”) is the public investment company listed on the London Stock Exchange analyzed in the previous section. It’s owned by public equity investors and was the first company advised by HSM. It has acquired over 140 catalogs and 65,000 songs and deployed over $2 billion of equity and debt capital. It pays HSM fees in exchange for providing advisory services (e.g., sourcing new acquisitions and managing HSF’s song portfolio).

Hipgnosis Songs Capital (“HSC”) is the private investment fund capitalized by $1 billion from Blackstone. It reportedly has acquired ~$300 million of catalog in 2022 from creators, including Justin Timberlake, Kenny Chesney, and the Leonard Cohen estate. It pays HSM fees in exchange for providing advisory services (e.g., sourcing new acquisitions and managing HSC’s song portfolio).

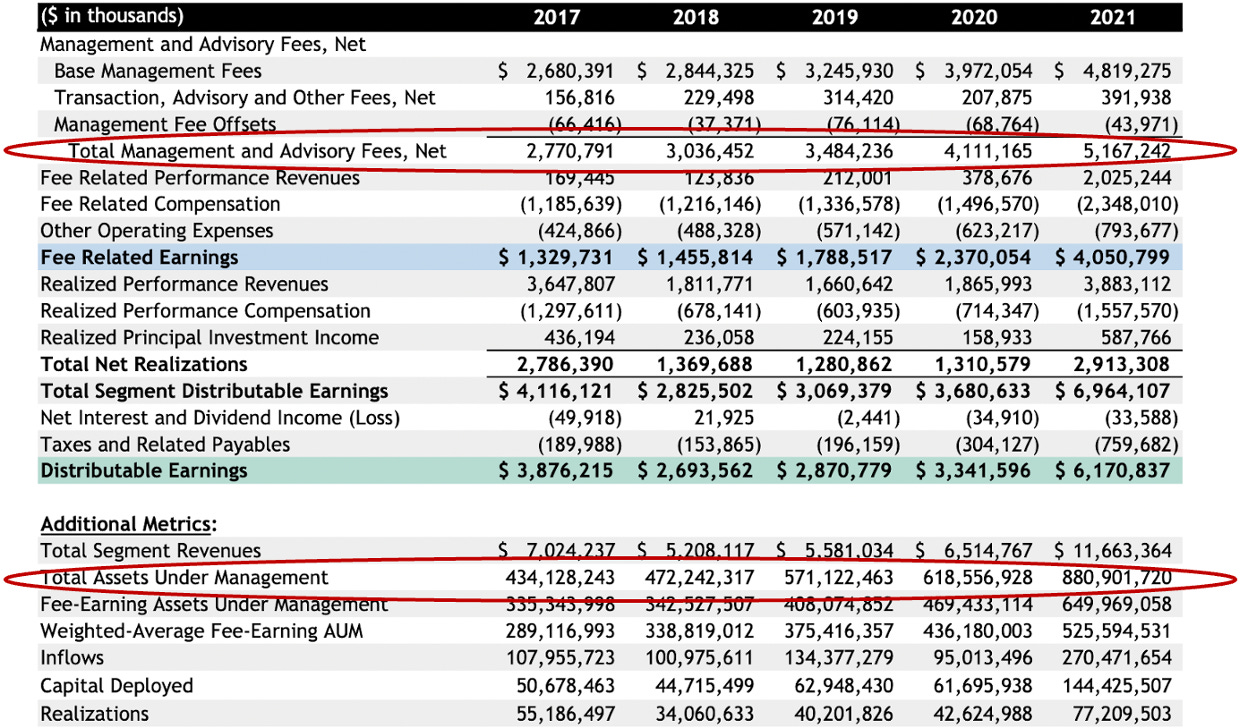

In short, Hipgnosis is structured similarly to an investment management firm. HSM manages its clients’ (HSF and HSC) capital. It is incentivized to deliver strong returns, so that its assets under management increase, causing its fee income to also increase.

To help visualize this, Blackstone’s financials results over the past five years are copied below. Its total revenues have grown as its assets under management increase. Meanwhile, its advisory fees – rather than performance fees – have made up the majority of its revenues.

Hipgnosis Songs Fund, a publicly listed company, discloses the fees it pays Hipgnosis Song Management, whereas Hipgnosis Songs Capital, a private fund, does not. In fiscal 2022, HSF paid $16.5 million in fees to HSM, an increase of 170% from the $6.1 million paid in fiscal 2020. Like Blackstone, the majority of HSM’s revenues are derived from advisory fees, with HSF’s advisory fee payment determined by its average market capitalization (a function of HSF’s share price and shares outstanding) in a period.

Before moving on, it’s worth noting a few potential considerations about Hipgnosis’ organizational structure after the Blackstone and Hipgnosis Song Management transaction:

Potential Conflicts of Interest: With Blackstone owning a majority of HSM, conflicts of interest may exist. For example, HSM may give preferential deal access / treatment to HSC (the Blackstone fund) over HSF (the public fund). HSM has tried to mitigate these concerns by instituting a conflicts of interest policy, which offers new opportunities to both funds with HSF having co-investment rights to participate in 20% of any catalog purchase. I’d argue that this is an OK outcome for HSF, but not an ideal one. HSF invested over $1 billion in deals sponsored by HSM, a first-time investment manager at the time, and allowed it to build its track record. In addition, HSF’s approval was required for HSM to advise the new Blackstone fund, so the company appeared to have leverage in negotiations. If HSF shareholders also had acquired an interest in HSM, interests would arguably be more aligned. But I guess this is a case of “you get what you negotiate.”

Change in Control: With Blackstone owning a majority of HSM, it will control key strategic decisions going forward. While Blackstone is incentivized to see Hipgnosis succeed, its numbers-driven culture may conflict with that of Hipgnosis. The Financial Times has suggested that Blackstone may be adjusting HSM’s underwriting process, which is leading to lower valuations and disputes with sellers. Will this impact Hipgnosis’ reputation with songwriters and artists?

With these basics covered, let’s tackle Hipgnosis’ approach to investing in music IP and how it’s currently fairing.

What is Hipgnosis’ Approach to Proving Songs are Investable?

With all of the above historical context set, let’s look at how Hipgnosis intends to deliver on its vision. While Hipgnosis has three stated goals, I’d argue that the company has clearly demonstrated how it’s working towards providing investors direct access to music IP and advocating on behalf of songwriters for improved economics. As a result, the remainder of this piece will focus on the third goal: Proving Music IP is an Investable Asset Class.

As highlighted above, Hipgnosis’ business model is similar to other investment managers. Hipgnosis Song Management seeks to deliver strong risk-adjusted returns for its clients – Hipgnosis Songs Fund and Hipgnosis Songs Capital – so that it can attract more assets thereby generating more fee income.

But what are “attractive risk-adjusted returns” exactly? And how does Hipgnosis create this value?

For attractive risk-adjusted returns, Hipgnosis Songs Fund appears to be targeting total returns, net of fees, of greater than 10% per year. During its initial investor meetings, Merck pitched this return target. In addition, HSF’s performance fee to HSM is contingent on achieving a 10% return per year. Meanwhile, Hipgnosis Songs Capital does not disclose its return target, but I’d assume that it’s similar – perhaps slightly higher given its relative lack of liquidity – to HSF’s 10%.

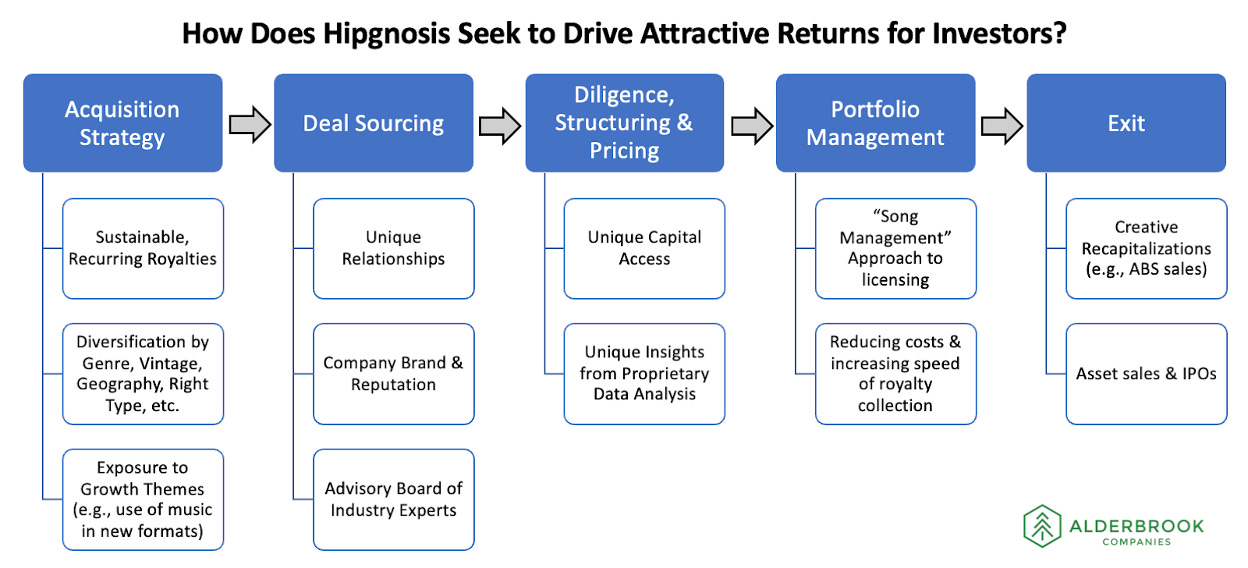

As for how Hipgnosis aims to create value, the company provides a long list in its Annual Report. I’d probably boil it into five broad categories that reflect the typical M&A lifecycle:

Acquisition Strategy: Hipgnosis is working to construct a portfolio that generates diversified and sustainable income with exposure to the industry’s secular growth trends (e.g., licensing to gaming, social apps like TikTok, Web3, etc.).

Deal Sourcing: This includes anything that helps Hipgnosis source unique and compelling investment opportunities. Examples are anything that gives Hipgnosis an edge in sourcing, including its brand, its management team’s reputation, and its advisory board’s relationships with songwriters and artists.

Diligence, Structuring, and Pricing: This includes anything that helps Hipgnosis price investments appropriately to both transact and deliver investors the targeted returns. Examples are anything that gives Hipgnosis an edge in valuation, including access to cheaper sources of capital and to unique insights from leveraging its proprietary data.

Portfolio Management: This includes Hipgnosis’ approach to actively managing its portfolio. In interviews, Merck has talked about Hipgnosis’ “Song Management” approach allowing it to generate more revenue from each song (via synchronization placements), because its team has more bandwidth to manage its portfolio compared to traditional publishers (i.e., 500 to 1,000 songs per employee vs. 20,000 songs per employee). Similarly, Hipgnosis has the ability to administer its US royalties allowing it to generate cost savings on US income streams for certain catalogs.

Exit: HSF has not suggested that it has any plans to sell / monetize its assets. Conversely, HSC will likely look for a path to exit in the future, given its Blackstone partnership. HSC has already pursued an ABS transaction to generate funds that were probably, at least in part, returned to equity holders.

In summary, Hipgnosis is trying to provide clients with consistent 10%+ net returns each year. It seeks to achieve these returns primarily through an effective acquisition process. Given this objective and process, the key question is can they deliver on it? So, let’s evaluate that.

How is Hipgnosis Faring & Where is it Headed?

Hipgnosis Songs Fund’s aggressive acquisition pace has made it difficult to gauge how well the company is doing to deliver strong risk adjusted returns (i.e., 10% net returns per year). However, with the M&A activity slowing since mid-2021, we have a better picture now than ever before. Is Hipgnosis’ acquisition strategy working? To answer this question, let’s take a look at the two key ways in which HSF shareholders’ returns – its share price performance and its dividends paid.

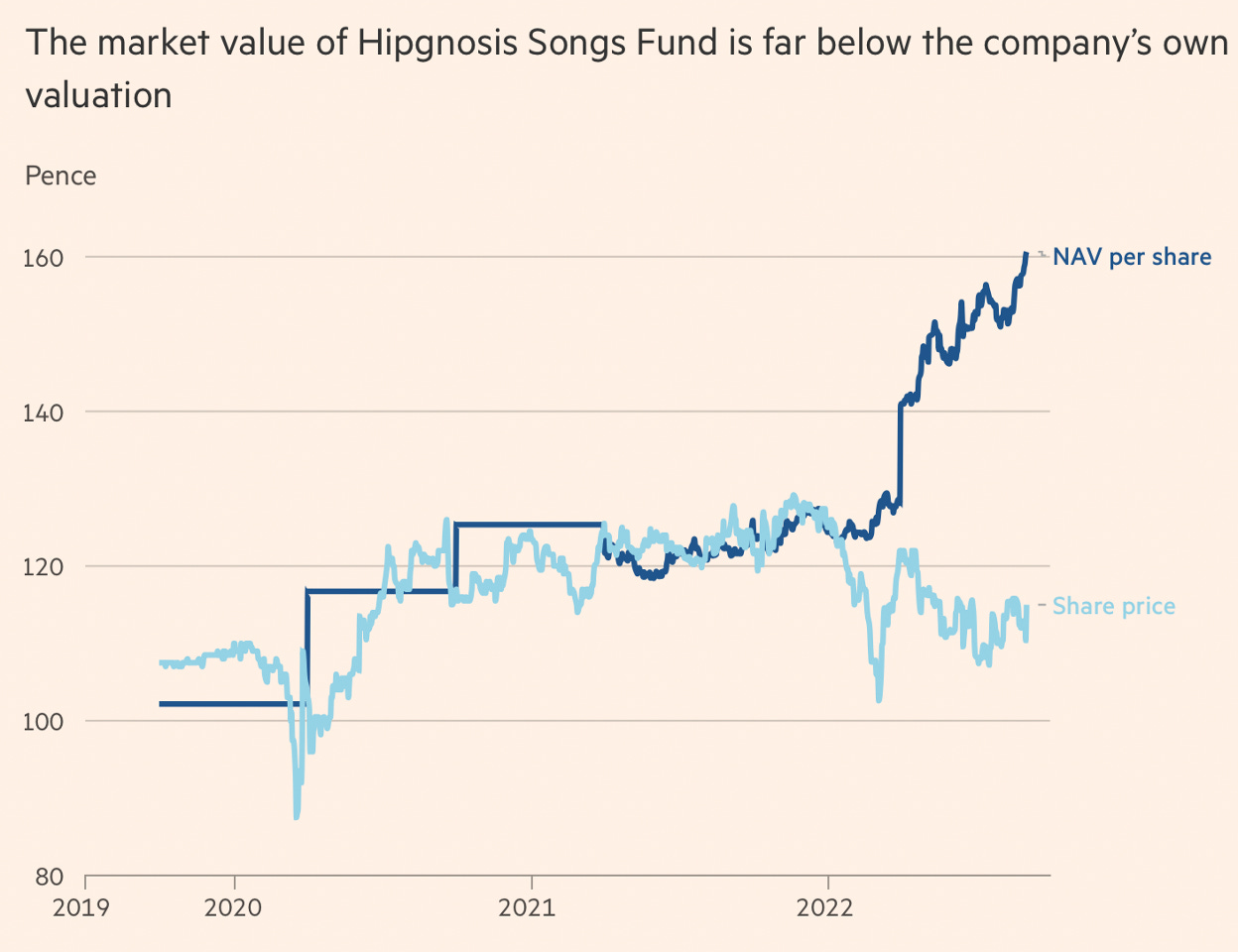

First up: Hipgnosis Songs Fund’s share price performance. As discussed earlier, the company’s revenue and EBITDA have exploded over the past four years. Along the way, HSF’s leadership has pointed to a metric called “Operative NAV per share” to evaluate how much value the company has created. What is Operative NAV per share? Simply put, it is a third party’s discounted cash flow valuation of Hipgnosis’ music catalogs divided by the company’s shares outstanding. As of March 2022, HSF’s Chairman Andrew Sutch noted that the Operative NAV per share increase plus dividends paid implied a 59% return on investment since IPO. On the surface, that sounds extremely impressive and more than meets the company’s return hurdle. There’s one big “but” though…

Hipgnosis Songs Fund shareholders can’t sell their shares at the Operative NAV per share. That said, up until March 2022, Operative NAV per share had roughly tracked HSF’s share price. However, the company’s share price has declined sharply since then, trading well below the latest Operative NAV per share valuation. As of November 2, 2022, HSF’s share price has declined ~18% since inception, significantly underperforming the company’s return target and the S&P 500’s 34% gain over the period.

A primary driver of HSF’s share price decline appears to be rising interest rates. Interest rates began rising sharply in early March 2022 and the company didn’t report annual results until mid-July 2022. Meanwhile, despite rising interest rates, Massarsky Consulting, HSF’s independent valuer, hasn’t increased the discount rate used in calculating HSF’s Operative NAV. The Financial Times has suggested that there could be conflicts of interest, because Hipgnosis pays Massarsky Consulting for valuing its catalogs. In the FT article, Massarsky’s CEO stressed that its work is “strictly independent.” On the other hand, a Massarsky executive said in a recent interview that the company is focused on “protecting” clients: “We will not have to raise our discount rate again. And as a result, we are protecting all of our clients: valuations will not go down.” Either way, HSF stock performance since inception has struggled to deliver the returns Hipgnosis had hoped.

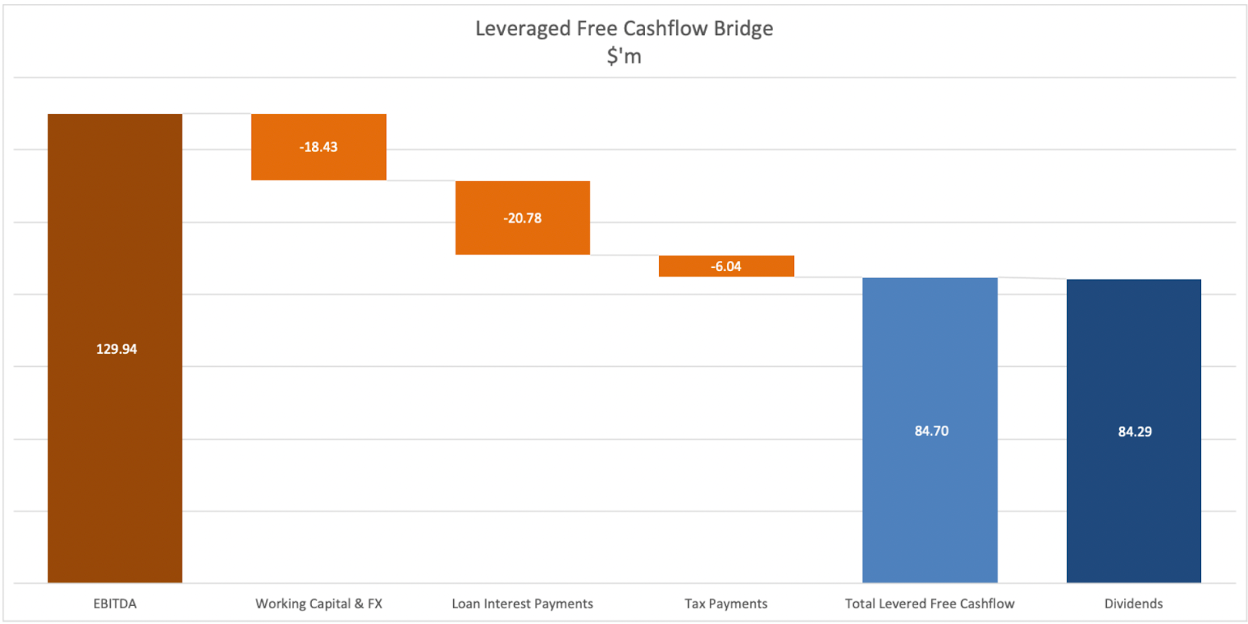

Second, Hipgnosis Songs Fund provides investors with a quarterly dividend. And on the surface, the dividend’s returns have been consistent and growing. HSF’s quarterly dividend per share has grown 160% from 0.5 pence per share in 2018 to 1.3125 pence per share in 2022. That said, the sustainability of HSF’s dividend is concerning upon a closer review of its financials. In fiscal 2022, Hipgnosis Songs Fund reported $84.7 million of levered free cash flow, barely enough to cover its $84.3 million of dividend payments.

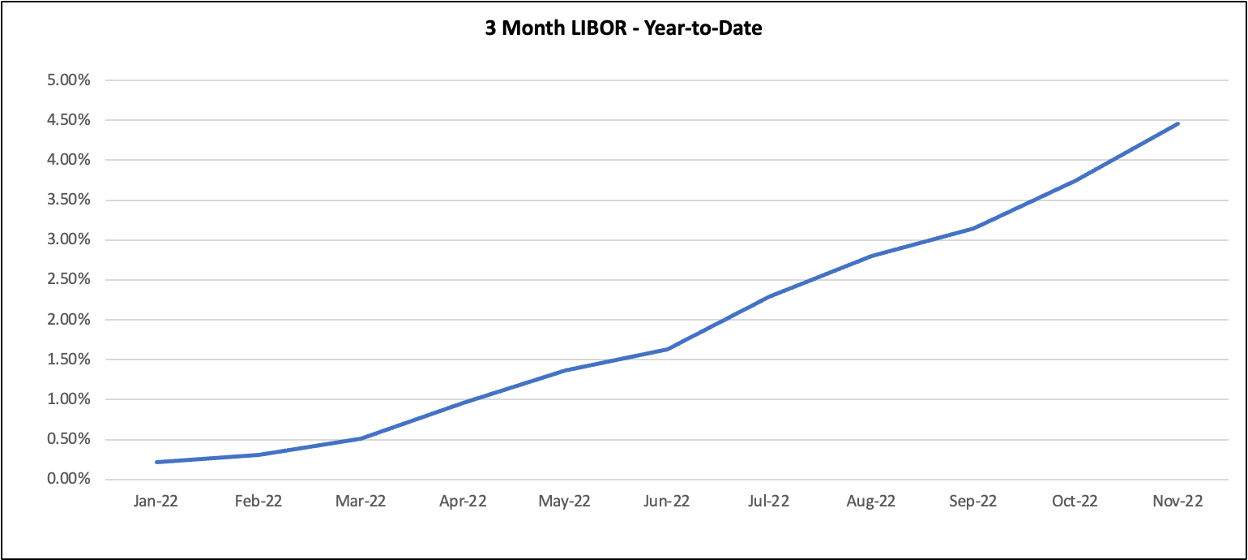

At the time, HSF had fully drawn its $600 million floating rate debt facility and only had $30 million of cash on the balance sheet. In a rising interest rate environment, it looked like the company would be burning cash and facing some hard choices to avoid a liquidity crunch. To mitigate this risk, HSF entered into a new $700 million debt facility and locked in fixed interest rate swaps at ~5.7%. Assuming the company still has $600 million of debt outstanding, its interest expense will rise $14 million (~60% year-over-year) to ~$34 million per year.

On the plus side, HSF’s Board reiterated its intention to pay the current dividend in fiscal 2023, citing its upsized $700 million credit facility and positive US royalty rate developments. Along these lines, JP Morgan recently released a note to its clients anticipating that the company’s cash flows may increase going forward. The strengthening US dollar relative to the British pound (“GBP”) could save HSF ~$10 million in GBP denominated dividend payments as well as on other GBP denominated expenses. In short, HSF’s debt refinancing has bought it time to realize growth in catalog income, but its ability to consistently fund the dividend from operating cash flows remains concerning.

Between its stock price performance and its dividend uncertainty, Hipgnosis Songs Fund’s acquisition strategy appears to be struggling to generate sustainable returns. Why is this the case? The issues facing the company include:

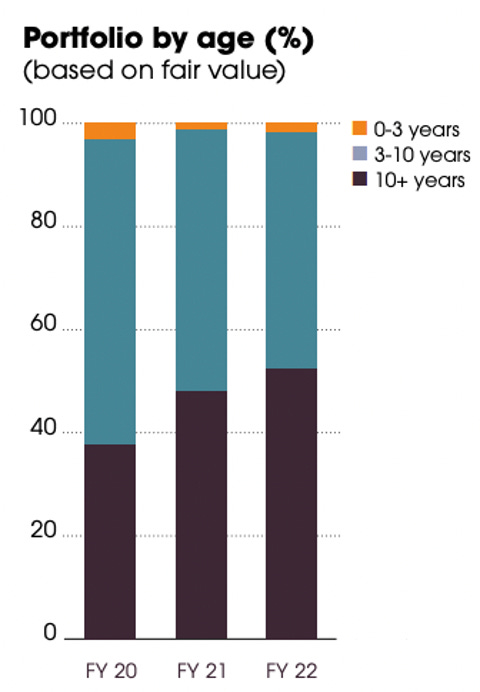

Portfolio age is still somewhat young. As discussed above, HSF’s acquisition strategy is focused on building a music IP portfolio with sustainable (ideally growing) income. The company diversified by various metrics, including genre and income source. That said, about half of its portfolio is less than 10 years old. This is important because music releases typically decline for the first several years after release. To offset these effects, I expect Hipgnosis to continue to focus on targeting older catalogs (10+ years of age) that can provide steadier cash flow.

M&A Overpayment. Similar to the previous point, HSF may have overpaid for its acquisitions, on average. The company released underwriting assumptions in 2021 that suggest it was estimating low- to mid-single digit growth for the average 10+ year catalog in its portfolio. These growth assumptions make sense in order to justify the math behind paying 15x to 20x+ multiples for 10+ year old catalog acquisitions. But actual growth appears to be coming in below those estimates. Based on data provided by Hipgnosis (depicted below), like-for-like total catalog income is decreasing and 10+ year old catalogs are actually not growing materially year-over-year. HSF has attributed these declines on COVID-related lockdowns that impacted its portfolio’s performance income. When it started its acquisition spree, it was the only pure play publicly-traded music IP investment vehicle of size. And in that sense, its most powerful moat may have been unique access to public equity capital. However, it doesn’t appear that this edge contributed to better pricing. And as more music IP companies go public, this edge now appears to have been largely competed away. Hopefully growth improves going forward, but I’d imagine the company’s underwriting assumptions are being scrutinized and debated internally. On a positive note, streaming income over the past six months appears to be growing significantly, and streaming services are beginning to introduce subscription price increases. Going forward, I wouldn’t be surprised to see Blackstone getting more heavily involved with Hipgnosis’ underwriting. I also expect the multiples that Hipgnosis is willing to pay to decline until it sees results that support more optimistic assumptions.

Too much reliance on floating rate debt to fund acquisitions. As mentioned above, HSF has used a growing amount of bank debt to fund recent acquisitions. Bank debt is typically one of the cheapest sources of capital but its interest rate fluctuates. In early 2022, global interest rates were low and HSF was borrowing for 3.25% to 3.75%. But as Central Banks around the world raise rates to fight inflation, HSF’s bank facility interest rate, which was tied to LIBOR, more than doubled to 6.5%+. In response, the company entered into a new bank facility and locked in a fixed interest rate swap at ~5.7%. It’s becoming more difficult to grow the cash dividend and build a cash balance to pursue more acquisitions with a higher interest expense. Hopefully catalog income grows so that HSF can pay down its debt balance and this becomes less of an issue going forward.

The potential impact of rising interest rates on its borrowing capacity. In addition to higher borrowing costs, rising interest rates could eventually force HSF’s third party valuer to increase its discount rate and lower the company’s Operative NAV. As it relates to the company’s borrowing, this could have major implications. The company’s prior debt facility allowed borrowings up to a maximum 30% of its Operative NAV. If the Operative NAV falls, HSF may face a significant liquidity issue to comply with the covenant and have its borrowing capacity limited going forward. That said, it’s unclear if the company’s new bank facility has a similar covenant to its prior one.

Concern about a dividend cut. As detailed above, Hipgnosis Songs Fund appears to currently be struggling to balance its cash inflows and outflows in a way that fully funds its dividend, especially as interest rates rise. If catalog income doesn’t increase sufficiently and/or its expenses aren’t reduced, the company may have to cut its dividend. This uncertainty has likely negatively impacted HSF’s stock price.

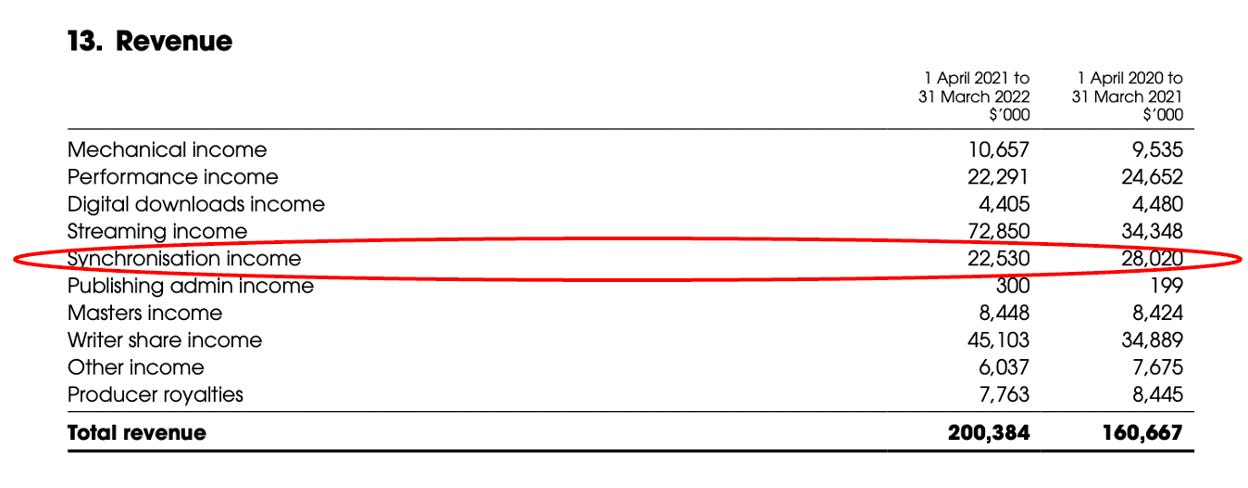

The Song Management strategy is likely underperforming in the aggregate. As discussed earlier, Hipgnosis prioritizes actively managing the songs in its portfolio. On HSF’s website, the company has great case studies showing examples of how it “turns classics into hits all over again.” However, in the aggregate, HSF’s synchronization income – which is derived from placements in TV, films, etc. – actually declined 20% in fiscal 2022 and only made up 11% of gross revenue (vs. 17% in fiscal 2021). Obviously Hipgnosis is digesting a lot of acquisitions and this is only one year of results. But it suggests that the system is at the least still being refined to deliver consistent returns.

Rising interest rates make exit strategies more difficult in the intermediate-term. While Hipgnosis Songs Fund has not expressed an interest in selling assets or all of the company, higher interest rates are driving prices down. For example, Hipgnosis Songs Capital completed an ABS transaction in August 2022. But these creative yield-based structures are likely to become less compelling for issuers like Hipgnosis as interest rates rise.

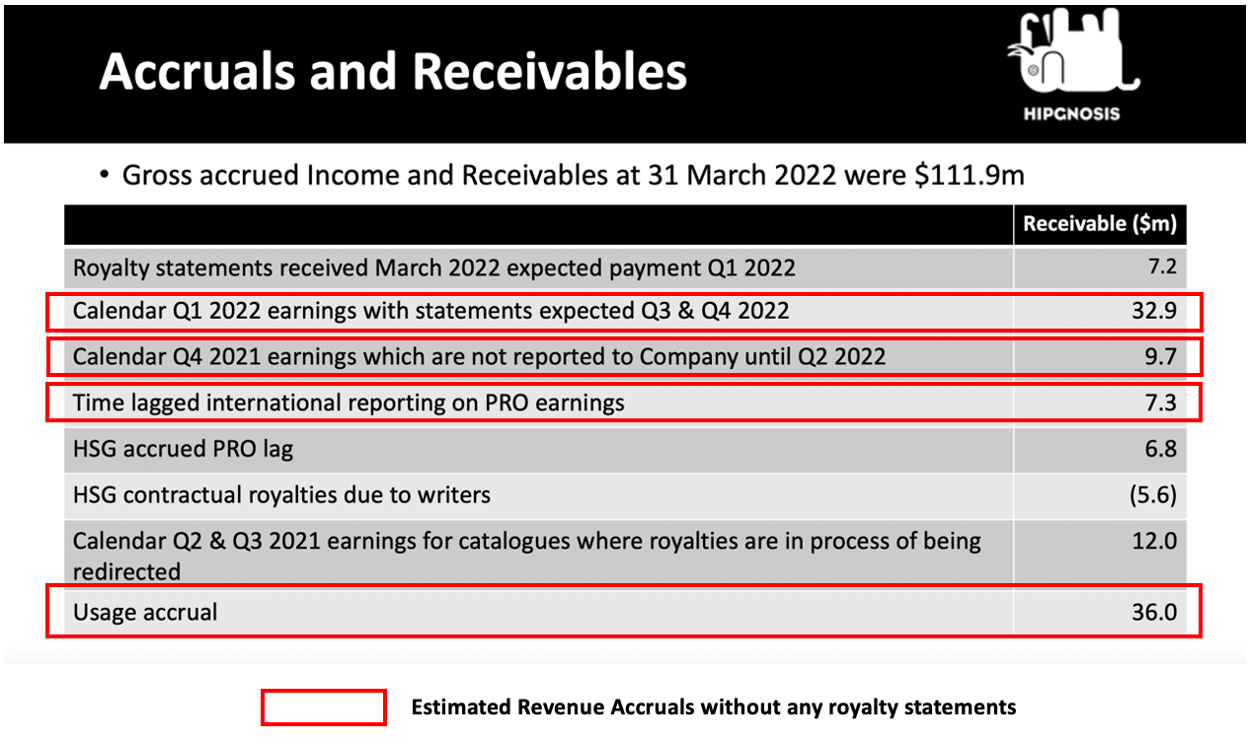

Potential accounting revisions. In addition to the above strategic issues, I’d argue that Hipgnosis Songs Fund has taken a somewhat aggressive approach to accounting. First, a significant portion of the company’s revenues are estimated prior to receiving an actual statement. For example, HSF booked $86 million of revenue (51% of total net revenue) in fiscal 2022 based on estimated future royalties that the company had not received statements for yet. Second, a meaningful percentage of net revenue is one-time in nature. In fiscal 2021 and 2022, HSF booked $29 million (21% of total net revenue) and $14 million (8% of total net revenue), respectively, in one-time income associated with acquisitions as revenue. Both of these accounting treatments introduce more uncertainty into how sustainable HSF’s reported revenue really is.

In summary, despite exponential growth over the past four years, Hipgnosis Songs Fund is struggling to achieve 10%+ annual net returns for its investors in the current environment. In my opinion, the macroeconomic environment as well as several factors in the company’s M&A process – from the Acquisitions Strategy to Structuring & Pricing to Portfolio Management – are causing returns to fall short of initial expectations.

As a result, I expect HSF will move away from an aggressive acquisition pace to a more defensive stance, in which it focuses on portfolio management and improving free cash flow generation. At the same time, I don’t expect Hipgnosis, the investment manager, to stop acquiring catalogs any time soon. HSM and HSC will likely continue to pursue catalog M&A with the remaining capital at their disposal. However, given results shown in HSF’s recent Annual Report, the Blackstone backed fund will likely be less willing to offer the multiples witnessed over the past four years.

How Might Hipgnosis’ Potential Risks be Mitigated?

After the previous section’s FUD-ish tone, I feel like Michael Scott from The Office is about to tell me to stop being such a buzzkill. After all, I believe that Hipgnosis Songs Fund still has ways to overcome its cash flow challenges, even if the path may be somewhat turbulent and 10%+ annual net returns from the IPO date seem unlikely in the near term.

These options include:

Consider transitioning away from a fixed dividend policy to a variable one. HSF is struggling to cover its current dividend with operating cash flow. Cutting the dividend is probably a last resort option because it will likely cause the stock price to decline sharply. Instead, the company could try to adjust the dividend policy in a creative way. For example, energy companies have shifted to a variable dividend policy to deal with the inherent nature of their volatile cash flows. In most cases, this involves a fixed quarterly dividend that can be easily covered, with a variable component that is a percentage of a company’s cash flows in the period. So when times are good, the dividend grows, and vice versa. The potential benefit to HSF is resetting the dividend payout to an appropriate size relative to operating cash flow while being able to credibly tell investors that the variable component can grow over time. The main downside, of course, is the quarter to quarter uncertainty in dividend payout amount. Nevertheless, I think it’s important for HSF to eventually have enough cash flow to both pay the dividend and build cash on the balance sheet in order to increase the dividend, to buy back stock, and/or to invest back into the business, which includes pursuing additional acquisitions to further increase cash flow.

Continue building a liquidity runway. As mentioned above, HSF ended March 2022 with $30 million of cash on the balance sheet and a fully drawn credit facility. To its credit, HSF management successfully added $100 million of liquidity in October when it refinanced into a larger bank facility. Going forward, I’d imagine HSF would want to conserve liquidity until it becomes more clear that operating cash flows can more than cover the dividend. To this end, I’m surprised HSF chose to draw down on its facility to buy back stock. Based on my math, HSF is trading at ~10.4x fiscal year 2022 net revenue. But remember that this revenue includes a meaningful amount of estimated accruals. If we adjust this revenue figure to include those accruals in which HSF has received royalty statements (what HSF calls “Pro Forma Annual Revenue” or “PFAR” in their Annual Report), the multiple increases to ~15.2x. So in addition to conserving cash for the time being, there might be better uses of that cash, such as accretive catalog M&A.

Generate licensing opportunities that increase the portfolio’s royalty income. Duh. But more seriously, let’s quickly recap some back-of-the-envelope math. Hipgnosis Songs Fund’s catalog has generated between $115 to $130 million of PFAR over the past two years. I expect the company to pay $30-$40 million in interest expense and $70-$80 million in dividends this year. That leaves a small window ($0-$30 million) to cover cash operating expenses. Point being, that any increase in royalties will go a long way. To that end, HSF’s streaming income grew significantly year-over-year, so a continuation of that trend would be impactful. Meanwhile, hopefully Hipgnosis can increase synchronization income by implementing its Song Management strategy.

Cut operating expenses wherever possible. The payroll and expenses associated with Hipgnosis Songs Group (formerly Big Deal Music) was $6.6 million in fiscal 2022. Perhaps some of these expenses could be shifted from HSF to HSM or HSC as Hipgnosis Songs Group administers HSC’s catalogs. Along these lines, it will be interesting to see if Hipgnosis decides to make any headcount reductions over the next few years. I’d also imagine some costs should be easier to reduce, such as the $6 million in “legal and professional fees” and $2 million in “aborted deal expenses” in fiscal 2022. In addition, the $16.5 million advisory fee paid to HSM in fiscal 2022 should be lower this year because of the decline in HSF’s market capitalization / stock price. If meaningful changes are necessary, it may make more sense to restructure out of the spotlight of the public markets.

Pursue accretive acquisitions. I know this seems counterintuitive given the prior bullets about building liquidity and cutting costs. However, if the macroeconomic picture worsens and catalog valuations decline, there could be opportunities for HSF to make accretive acquisitions.

Hipgnosis Songs Fund’s decision to build its iconic song portfolio quickly made sense at the time. It saw an opportunity to acquire catalogs that it deemed undervalued and moved quickly before the space became more competitive. But now that the macroeconomic environment has changed and the portfolio’s actual results may not be living up to the underwritten growth expectations, the company likely needs to iterate its approach to mitigate several potential risks.

Closing Thoughts

Hipgnosis has made a series of aggressive bets:

It spent billions of dollars on iconic music catalogs in a short period of time.

It seemingly paid prices that assume these catalogs, in aggregate, continue to grow consistently into the future.

It scaled to a ~90+ person team quickly to properly manage its evergreen portfolio of songs.

It focused its initial capital raises to execute its acquisition strategy on the public markets meaning its execution is under closer scrutiny.

It has been outspoken about how it feels the music industry does not properly value songwriters’ contributions.

As a result, certain aspects of Hipgnosis Songs Fund’s financial results are concerning. In particular, they suggested that like-for-like catalog growth has not been growing consistently. It remains to be seen if this is a one time blip caused by the pandemic or if larger issues exist.

That said, it feels like Hipgnosis is at a turning point and that things might be changing over the next 12-24 months. Over its first few years of existence, the company’s moat was accessing relatively cheap public market capital to pay higher prices than its competitors. For a time, this gave Hipgnosis an edge. But with new capital from public equity markets seemingly closed off for now, its focus will likely shift to optimizing the assets in its portfolio via creative licensing placements, improving collections, and more. Don’t get me wrong. Regardless of what happens at Hipgnosis Songs Fund, Hipgnosis Song Management and Hipgnosis Songs Capital appear poised to continue acquiring timeless songs. But it still feels like the company needs to shift from aggressive offense to something more measured.

For now, Hipgnosis has achieved two of its goals: 1) it has provided public market investors with direct access to music IP and 2) it continues to advocate for songwriters’ economics. Over the long term, though, for Hipgnosis to accomplish its third goal and establish music IP as a valuable asset class, the most important thing will be delivering returns to its investors.

I’m personally bullish on music IP as an asset class, and I’m rooting for Hipgnosis to be successful. In a world where Hipgnosis succeeds, songwriters and artists will have better financing options for their IP. It’s also a world where songwriters are paid a better share of the pie and investors realize solid risk-adjusted returns. Hopefully the company’s results improve quickly and the industry can learn from some of its recent challenges. For all these reasons, I’ll be paying close attention to Hipgnosis and the catalog M&A space in the coming months.

Thanks to Hannah and Adam for the feedback, input, and editing! If Alderbrook can help you build or fund companies in this space, please reach out!